It’s a term that’s been around since the early 2000s but is now firmly part of the financial lexicon: Impact Investing.

by Cronje Wolvaardt, Minderoo Foundation

Studies show that the deployment of capital aligned with purpose is firmly on the rise in Australia. A recent report by Impact Investing Australia and the UNSW Centre for Social Impact found Australia’s impact investing market has grown nearly eight-fold since 2020, with more than $157 billion invested in purpose-driven assets.

In fact, the total value of public impact products has grown from $20 billion in 2020 to $157 billion in 2025, with much of the growth driven by the market for green, social and sustainability (GSS) bonds.

So how does impact investing help address systemic challenges at scale?

Take exposure to chemicals in household plastics as an example. We know that exposure to chemicals found in common plastics increases health risks throughout the entire human life span.

This includes impacting birth outcomes, child neurodevelopment, reproductive health, and metabolic, endocrine and nutrition systems.

But it’s not enough to highlight the avalanche of evidence linking plastic chemicals to human health harms and simply call for change – although that’s important, too – What’s equally important is championing real world solutions to the plastic crisis.

This is where Minderoo’s Strategic Impact Fund (SIF) comes in.

Launched back in late 2021, the SIF is a $250 million allocation used exclusively for impact investing. In addition to this fund, $25 million is allocated to catalytic capital – investments that accept higher risk or lower returns to invest in projects with high social or environmental impact that may struggle to attract finance.

Through the SIF and catalytic capital, we have so-far committed around $150 million to projects that align with Minderoo’s mission to uplift communities, support gender equality, protect natural ecosystems and respond to emerging threats and challenges.

But it’s important to not just think about government and philanthropy solving these problems, you’ve got to bring investment and commercial capital to problems.

Impact investing can create both environmental and social outcomes and generate financial returns – proving that solving systemic problems and building scalable businesses are not mutually exclusive.

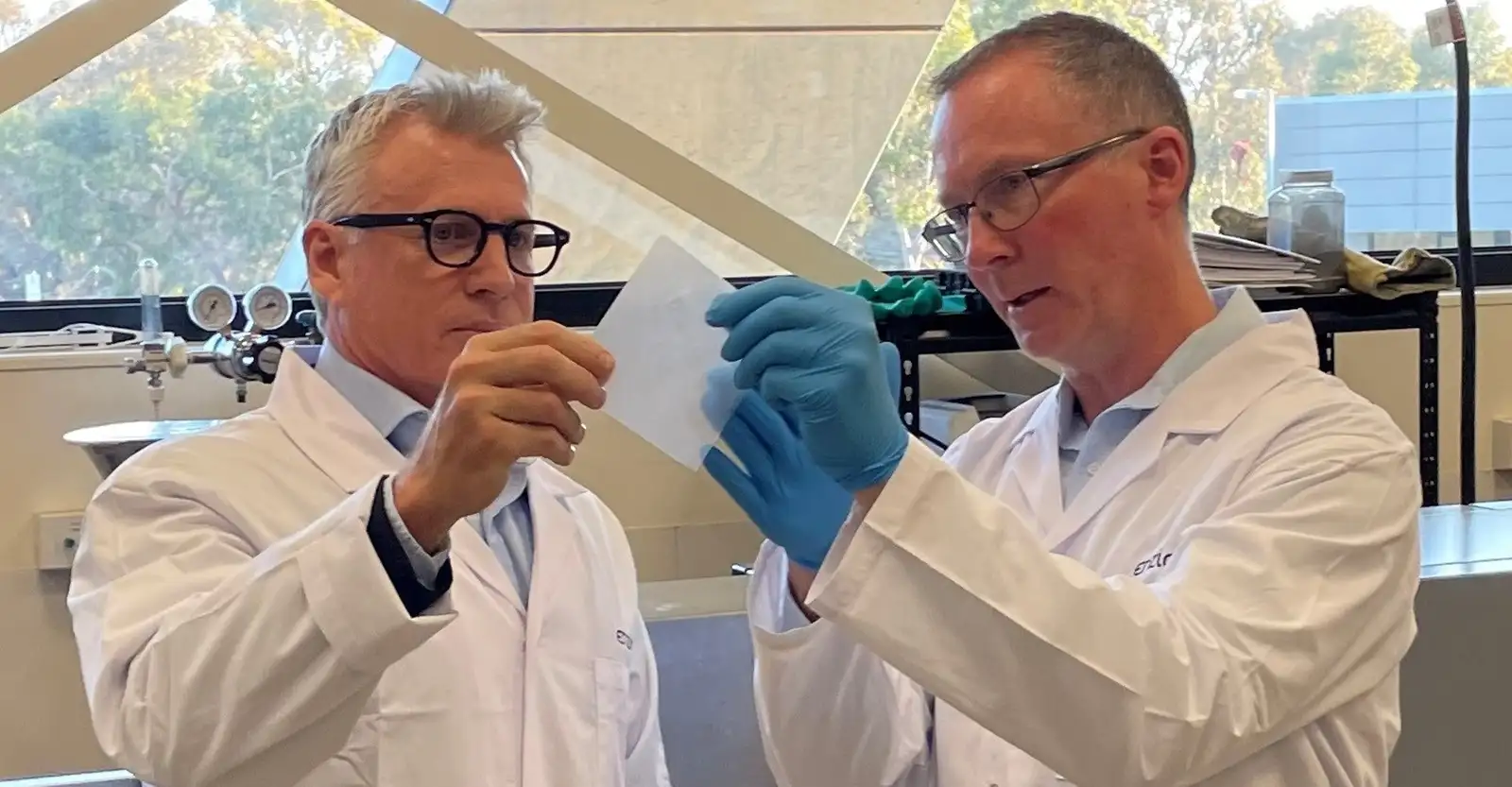

Enzide Technologies and Kalpana Systems are the most recent examples of Minderoo deploying capital for good, backing sustainable materials companies that are working to deliver sustainable packaging solutions.

Supercharging bioplastics to break down cleanly and quickly

Enzide Technologies is a Western Australian company scaling up enzyme-based additives, using enzymes developed by CSIRO and Enzide’s US enzyme partner, Ginkgo Bioworks. These additives are mixed into bio-degradable bioplastics at the manufacturing stage and operate to accelerate their biodegradation after use, without leaving harmful microplastics.

Bio-degradable bioplastics already exist – but they often don’t degrade or compost fast enough, particularly when thicker products are manufactured.

This technology enables the next generation of safe and sustainable bioplastics that can be applied to a broader spectrum of applications - providing a real alternative for the most polluting plastic products, particularly single use products.

With Enzide Inside, these products have their own end-of-life solution already built in. They can do their job and disappear fast, without harming the environment if accidental leakage happens.

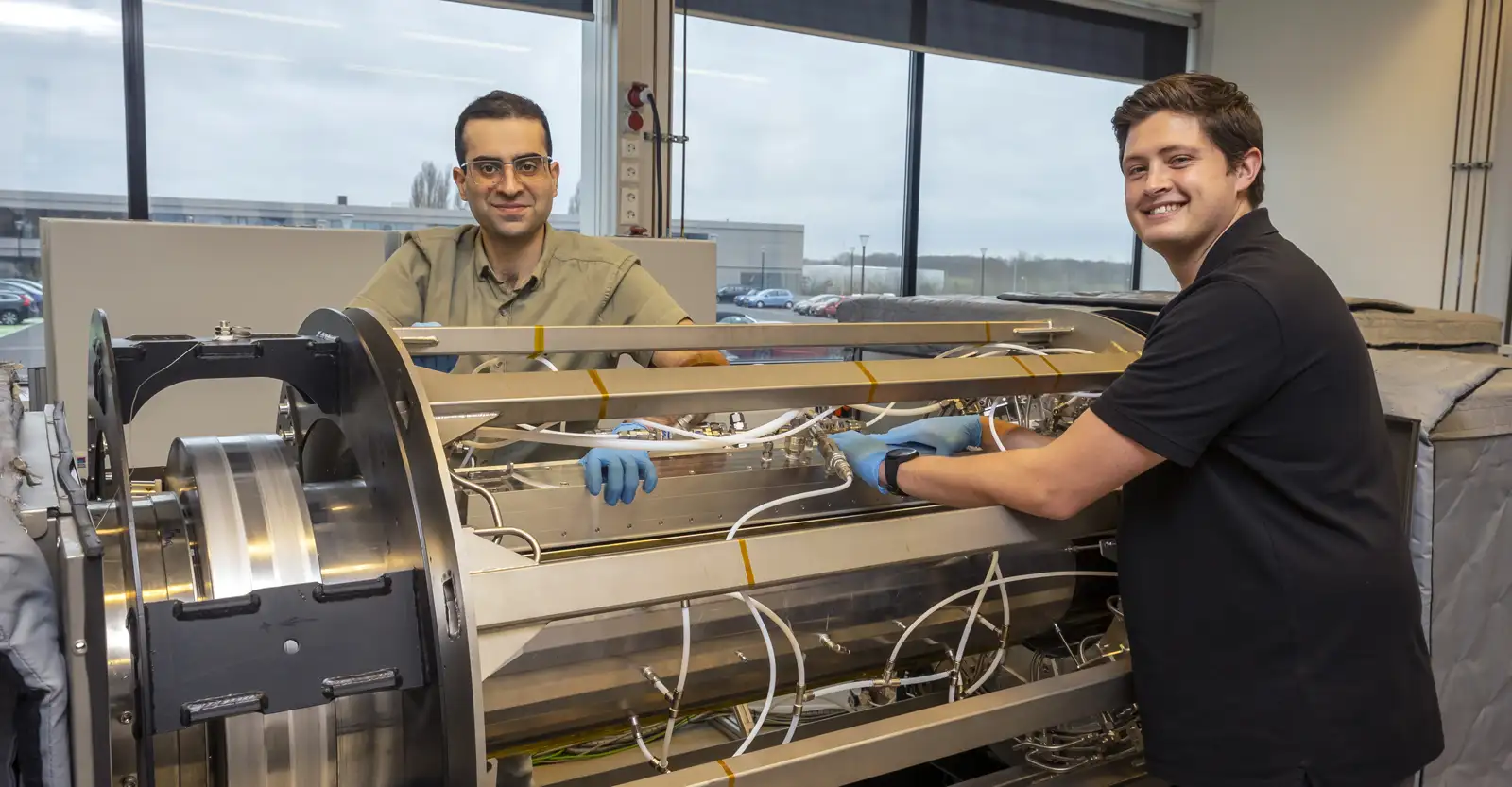

Invisible coatings unlock a new era for recyclable packaging

Dutch start-up Kalpana Systems is solving a decades-old packaging conundrum: containers for products like chips or coffee either have plastic coatings that protect products but contaminate recycling systems, or uncoated paper that’s recyclable but fails when exposed to moisture.

Kalpana Systems’ nano coating is 5000 times thinner than human hair, invisible to paper recycling streams and scalable at an industrial level.

The result? Complete protection against moisture, oxygen, and grease, unlocking paper packaging as a viable replacement for plastic without the need for complex multilayer packaging.

Now that’s what we call turning innovation into impact.